BUSINESS UPDATE – Appendix 4D Release

>> Download Appendix 4D – click here

HIGHLIGHTS

- Sales invoiced and shipped up 14% to $19.2m for H1 FY23 with CMP maintaining $40m plus FY23 guidance

- Somfit® and Nexus 360 commercial activities accelerating

- MEG review and reset

- Reported NPAT H1 FY23 is ($7.2m) with ($6.9m) adjustment for MEG re-set and CMP believes that H2 FY23 should deliver $3m EBITDA with FY23 underlying EBITDA at $2.0m

- Extra investment in P&L product development, sales team, and marketing over the last six months in key markets to underpin ongoing revenue growth have led to CMP expensing $1.9m more than expected

- CMP notes sales above $40m for FY23 with new product sales at higher margin across the fixed cost base, and we are targeting an EBITDA above $4m in FY24

- CMP maintains a cash balance of $5.5m, and access to $1.5m of additional debt with our net debt position being $2.4m

- Paul Jensz to step off the board at end of March 2023, due to time constraints with new executive appointment.

PERFORMANCE OVERVIEW H1 FY23 (six months to 31 December 2022)

- Revenues for H1 FY23 were $19.2m compared to $16.8m in H1 FY22 or 14% higher. FY23 revenues are expected to be in line with existing guidance, being at least $40m

- Reported EBITDA loss of $(4.8)m for H1 FY23, compared to $1.2m profit for H1 FY22 and comprises $3.8m related to MEG EBITDA adjustments. Underlying EBITDA loss for H1 FY23 of $(1.0)m, with significant investment ($1.9m) expensed in H1 FY23 related to sales and marketing activities and new product pre-release activities. Underlying H2 FY23 EBITDA to return to profits

- Sales orders taken in H1 FY23 were $17.4m compared to H1 FY22, excluding MEG, of $22.8m, due to the timing of annual sales order commitments out of China. Annual sales order commitments from China were received in H1 FY22 but new annual sales order commitments from China have yet to be issued for FY23. The Company does expect annual sales order commitments from China in H2 FY23, and expects sales orders taken for the full year to be at least $40.0m

- Operating cash flow of $(0.9)m for H1 FY23, compared to $0.8m for H1 FY22. H1 FY23 OCF impacted by investments in incremental sales and marketing resources and new product pre-release activities

- NPAT decreased to $7.2m loss for H1 FY23 compared to $0.3m profit for H1 FY22. This includes non-cash adjustments for the MEG business of $6.9m. Underlying H2 FY23 NPAT to return to profits

INVESTOR OVERVIEW

- Core Business:

- Profitability in H1 FY23 was impacted by investment in additional sales and marketing resources which was put in place during H1 FY23 to drive revenue growth, primarily in the US, over calendar 2023, but in other key markets as well. Underlying profitably to be restored in H2 FY23

- Expenses have been incurred in H1 FY23 related to several new products being readied for market release, including Okti, a new generation hardware platform for neurological monitoring, Falcon HST, a new home sleep test device for the sleep diagnostic and monitoring market and Somfit, a new wearable sleep device

- Orion MEG:

- Second ORION LIFESPAN™ MEG sale to TJNU in China progresses towards shipment

- ORION LIFESPAN™ MEG installation at Barrow Neurological Institute (BNI) is being removed based on mutual commercial agreement

- $6.9m of costs (non-cash) booked to H1 FY23 result

- The Company is reviewing the current MEG position and will provide further updates at the appropriate time in the future

- Somfit and eHealth:

- Nexus 360: sites continue to be added, with the expected run rate for annualised revenues approaching $2m pa in FY23

- Somfit® sleep device: discussions and active projects continue with several third-party commercial agreements being negotiated. The Company expects to book up to $1.0m in revenues based on current contracts being executed

- Full-Year Guidance:

- The Company expects revenues for FY23 to be at least $40m and for EBITDA to recover to an underlying annual rate of at least $3.0m in the second half, which would leave underlying FY23 EBITDA at around $2.0m, excluding the MEG asset valuation adjustments

Compumedics Limited (ASX: CMP) (“Compumedics” or “Company”) announces its financial results for the half-year ended 31 December 2022 (H1 FY23).

During the period H1 FY23, Compumedics generated revenues from the sale of goods and services of $19.2m, representing an increase of 14% over the previous corresponding period (pcp) of $16.8m.

Revenues booked for H1 FY23 were, by geographic area, 39% higher in France in H1 FY23 compared to H1 FY22, 8% higher in Europe, 17% higher in North Asia and 135% higher in the Middle East. These increases were offset by declines in shipped and invoiced revenues in the US of 3% and Australia of 4% with DWL like the pcp.

The Company took new sales orders for H1 FY23 of $17.4m compared to $27.0m of new sales orders taken in H1 FY22. Included in new sales orders taken in H1 FY22 was the second MEG sale at $4.2m. Excluding this sale, new sales orders taken in the core business in H1 FY22 were $22.8m. The decrease in sales orders taken for H1 FY23, excluding the MEG order, was 24% compared to H1 FY22 and was a result of decreased sales orders taken in Asia (down 70%), Japan (down 25%) and Australia (down 27%) The declines in Asia are primarily related to timing of annual contract sales orders particularly out of China. These orders were received in H1 FY22, but not H1 FY23. The Company expects new sales orders from China in H2 FY23. Furthermore, in both Japan and Australia orders taken were less than the pcp primarily due to timing of sales orders. These declines were partially offset by gains in Germany (up 14%), the Middle East (up 263%) and DWL (up 6%), with the US in line with the pcp.

The Company continues to invest significantly in new products for the core business as well as pursue current Somfit® commercial opportunities. As a result, EBITDA was a loss of $4.8m for H1 FY23 compared to $1.2m achieved in H1 FY22. This underlying loss was driven by several factors including:

- The write down and full provisioning for assets relating to the MEG business. The decision to expense these items to the income statement for the period was due to the decision to take back the MEG system at BNI. The total pre-tax expense was $6.9m, which is non-cash and was a $3.8m adjustment at the EBITDA line

- Other income being lower in H1 FY23 ($0.2m) compared to H1 FY22 ($1.4m). This was primarily due to the forgiveness of the COVID debt ($0.9m) in the US business in H1 FY22, which was once-off

- Expenses were higher ($1.0m) because of the Company’s deliberate decision to increase sales and marketing resources, particularly in the US as we prepare for the release of several new products in this key market over calendar 2023. This investment in key new sales positions and key account manager positions is an investment in future revenue growth, which we expect to see in H2 FY23 and H1 FY24

- Increased expenses ($0.9m) were incurred as the new products are readied for sale across all key markets in Australia, Europe and the USA. These costs include tooling, prototypes, clinical trials etc. Some of these costs will not re-occur in H2 FY23

- Slightly lower gross margin at 50% compared to 51% for H1 FY22. Gross margins were lower due to product and geographic mix as well as higher input costs, not being fully passed on to customers with higher prices

- Financing charges were also higher in H1 FY23 by $0.2m compared to the pcp because of an increase in debt and the increase in interest rates.

The Company is currently focused on growing revenues with the resources engaged to achieve this and actively working through other operational and expense efficiency opportunities to restore profitability over H2 FY23 and H1 FY24.

H1 FY23 to H2 FY23

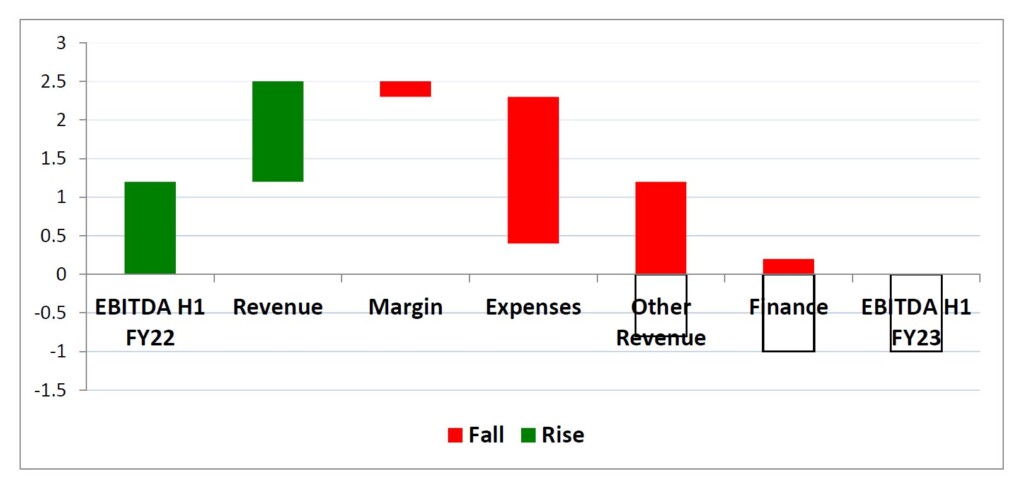

H1 FY23 revenues of $19.2m led to an underlying EBITDA result of a $1.0m loss. The bridge chart below shows the key movements in underlying EBITDA from H1 FY22 to H1 FY23.

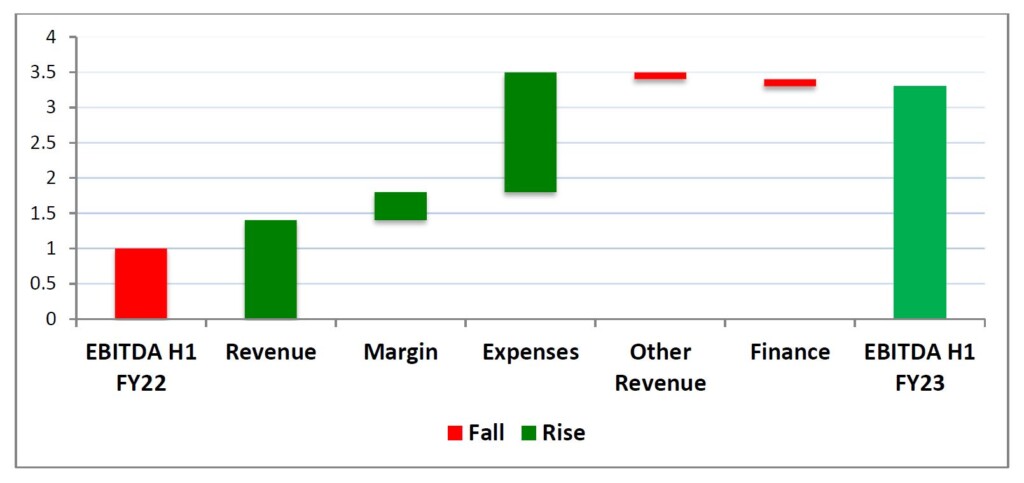

The Company expects revenues in H2 FY23 to be at least $21.0m and for underlying EBITDA to return to a profit of $3.0m, resulting in an approximate underlying EBITDA of $2.0m for FY23. The bridge graph below shows the key components that will drive the return to profitability.

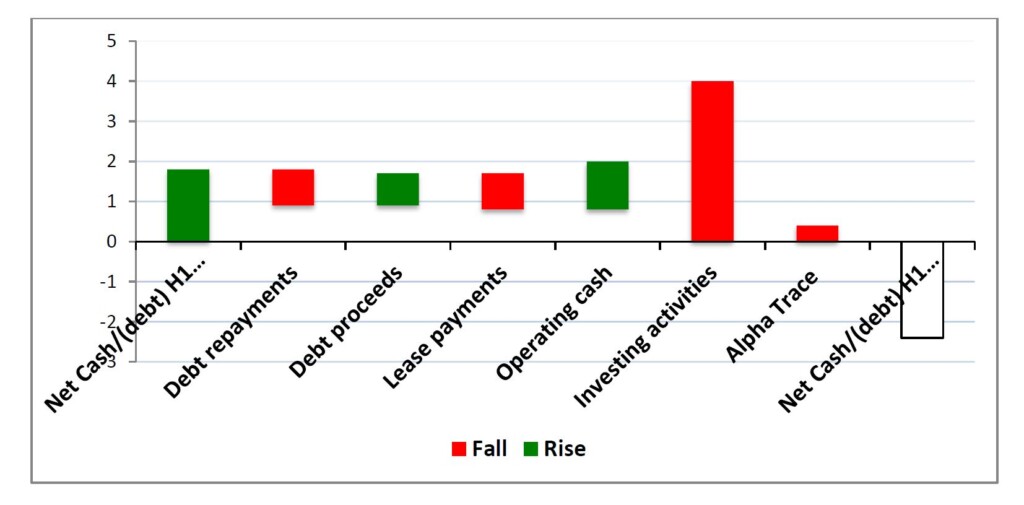

The Company’s net cash/debt position moved from net cash of $1.8m at H1 FY22 to a net debt of $2.4m at H1 FY23. This resulted from the increased expenses related primarily to increased sales and marketing costs and the increase in costs related to pre-release activities for the new products about to be launched. The bridge graph below shows the key components that led to net cash moving to net debt, which largely relate to investing activities to drive growth.

CORPORATE

Key Growth Opportunities

The Company is continuing to focus on several initiatives to underpin both current and future growth, including:

- New product platform roll-out to significantly expand addressable market

- Over the next 12 months the Company will launch two new major product platforms for home sleep-testing for the sleep market (Falcon®), as well as a new range of laboratory and portable neuro-diagnostic and monitoring devices (Okti®) for epileptic and well as general neurological monitoring.

- Growth in international sales with expansion plans in the US, Germany, France and other key Asian markets

- The Company will continue to expand its US sales team to grow market share in both sleep and neurological diagnostic and monitoring markets

- In Germany and France, the Company will pursue sales resources for both sleep and neurological diagnostic and monitoring markets

- The Company, acknowledging the current geo-political issues, will continue to build on its long-term relationships in China to advance the Company’s businesses in the region

- eHealth: Developing the commercialisation of cloud-based sleep diagnostics platform

- Compumedics continues the rollout of its professional cloud-based sleep diagnostic platform, Nexus 360, to key sites in the US and other key markets around the world

- Compumedics has commenced several clinical validation projects focused on the commercialisation of its consumer, cloud-based sleep diagnostic platform, Somfit®, and will update the market as key milestones are met

- DWL: Expansion opportunities with the newly granted break-through auto-scan TCD patent to be pursued

- The Company will continue to develop its technologies around the 3D Transcranial Colour Doppler (3D TCCD)/Duplex and PLL/Robotic imaging, while refining the best way to fully exploit this commercial opportunity

Financial Outlook

Compumedics expects the identified key growth opportunities to deliver an increase in revenues and earnings in the current financial year.

The Company expects revenues for FY23 to be at least $40m and for EBITDA to recover to an underlying annual rate of at least $3.0m in the second half, which would leave underlying FY23 EBITDA at around $2.0m, excluding the MEG asset valuation adjustments.

For further information please contact:

Dr David Burton

Executive Chairman, CEO

Compumedics Limited

Phone: + 61 3 8420 7300

Fax: +61 3 8420 7399

David Lawson

Director, CFO

Compumedics Limited

Phone: + 61 3 8420 7300

Fax: +61 3 8420 7399

Authorised for lodgement by Compumedics Limited’s Board of Directors

About Compumedics Limited

Compumedics Limited [ASX: CMP] is a medical device company involved in the development, manufacture and commercialisation of diagnostics technology for the sleep, brain and ultrasonic blood-flow monitoring applications. The Company owns US based Neuroscan and Germany based DWL Elektronishe GmbH. In conjunction with these two subsidiaries, Compumedics has a broad international reach, including the Americas, Australia and Asia Pacific, Europe and the Middle East.

Executive Chairman Dr. David Burton founded Compumedics in 1987. In the same year the Company successfully designed and installed the first Australian, fully computerised sleep clinic at Epworth Hospital in Melbourne. Following this early success, Compumedics focused on the development of products that sold into the growing international sleep clinic and home monitoring markets.

Compumedics listed on the Australian Securities Exchange in 2000. Over the years, Compumedics has received numerous awards, including Australia’s Exporter of the Year, and has been recognised as a Top 100 Innovator by both German and Australian governments.