COMPUMEDICS FULL YEAR RESULTS FY2021

Delivering Sound Financial Position as Key Enabler to the Resumption of Growth Focus

KEY HIGHLIGHTS

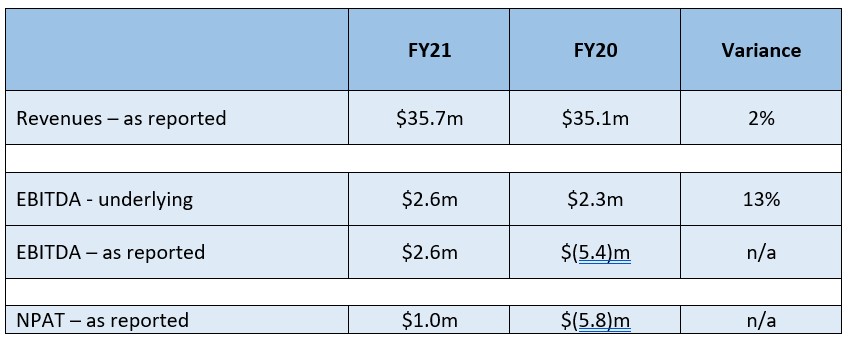

- Revenues from shipped and invoiced sales were $35.7m for FY21, up 2% on FY20 ($35.1m). On a constant currency basis revenues were up 9% FY21 compared to FY20

- EBITDA improved to $2.6m for FY21, compared to a $5.4m loss for FY20. The reported EBITDA loss of $5.4m in FY20 was after the write down in value of the intangible asset by $7.7m

- NPAT improved to a profit of $1.0m in FY21 compared to $5.8m loss in FY20. The reported NPAT loss of $5.8m for FY20, was after the write down in value of the intangible asset by $7.7m

- Core business sales orders taken of $35.3m in FY21 were the same as FY20. On a constant currency basis, they were 8% higher FY21 compared to FY20

- Cash on hand increased to $6.8m on 30 June 2021 compared to $6.4m on 30 June 2020

- Company continues to actively pursue ongoing step-out commercial growth opportunities for the MEG and Somfit technology platforms

INVESTOR OVERVIEW

- Core Business:

- The Company benefited from its diversified revenue streams (both geographic and product line) in FY21, with FY21 compared to FY20 revenue growth in France, Germany, and other parts of Europe and the DWL business, offset by declines in Asia, and the USA brain research (Neuroscan) business, whilst Australia was consistent with the prior year.

- eHealth:

- Compumedics has consolidated its Nexus 360 installation base with over 56 customers across both PSG and EEG (> 350 beds and 110 systems) in both the USA and Australia. The Nexus 360 platform generated A$1.1m revenue in FY21, with total signed contract value exceeding A$1.7m in annual subscription fees. Revenues have continued to be temporarily impacted by the closure of labs due to the COVID-19 Pandemic

- Somfit – the Company has progressed several research and collaborative arrangements as part of the validation and commercialisation of the Somfit technology over FY21

- Compumedics is in active discussions with interested third parties in relation to potential initial commercial applications for the Somfit device

- Neuroscan/MEG:

- The Company continues to progress the installation of its first MEG system at Barrow Neurological Institute in Phoenix, Arizona, despite the COVID-19 impacts of lockdowns and border restrictions

- The Company continues to pursue other MEG opportunities

- FY22 Guidance:

- The ongoing and uncertain impacts of the COVID-19 Pandemic on our key markets around the world continue to make it difficult to forecast the Company’s expected results, for any given future period. As such, the Company remains unable to provide guidance currently, but anticipates further growth and improvement in the financial performance of the business in the financial year ahead

Compumedics Limited (ASX: CMP) (“Compumedics” or “Company”) wishes to announce its financial results for the full year ending 30 June 2021 (FY21).

Compumedics’ reported net profit after tax (NPAT) increased in FY21 to a profit of $1.0m. This compared to a loss of $5.8m in full-year 2020 (FY20) because of the non-cash write down of intangible assets by $7.7m. EBITDA for FY21 was $2.6m, an increase on the $2.3m in FY20, after removing the once off intangible asset write-off in FY20. Shipped and invoiced sales increased 2% to $35.7m for FY21, compared to $35.1m for FY20. The Company took new sales orders in FY21 of $35.3m, which was consistent with new sales orders taken in FY20.

The increase in revenues reflects the benefits of the Company’s diversified revenue base, both geographically and on a product line basis. Over the course of FY21 different countries and markets within those countries were impacted differently because of the ongoing COVID-19 pandemic and the measures taken to address the virus. As a result, the Company was able to improve its revenue performance over FY21 compared to FY20.

Despite the pandemic, Europe performed well with growth recorded in France, Germany, and other parts of Europe. Our DWL business, based in Germany, also grew by 6% over FY21 compared to FY20. Whilst Asia declined, the falls were smaller than the prior year at 4% for north Asia, predominantly China and Japan, which declined 26% as a result of the on-going issues with the pandemic in Japan. Australia performed in line with the prior year.

Margins improved because of the growth in revenues, increasing from 51% in FY20 to 54% in FY21. The increase in margins reflects the increase in the volume of sales, despite the strengthening Australia Dollar, against the US Dollar over the course of FY21. Margins continue to be positively impacted by the on-going efficiency gains from the Company’s ongoing project to review manufacturing and minimise double handling of product globally together with new products being engineered at a lower target cost.

EBITDA for Compumedics improved on a reported basis and on an underlying basis. EBITDA, as reported improved from a loss of $5.4m in FY20 to a profit of $2.6m in FY21. In FY20 the reported EBITDA loss of $5.4m was impacted by a non-cash $7.7m write down of the value of the Company’s intangible assets. The underlying EBITDA result in FY20, removing this non-cash charge, was a profit of $2.3m. This compares to the FY21 result of $2.6m. The improvement in EBITDA in FY21 on this comparison is largely a result of higher revenues, higher margins, and on-going cost containment/management. With this said, the Company continued to invest in both its MEG and Somfit growth platforms.

The following table highlights the key financial performance measures on this basis:

OPERATIONS

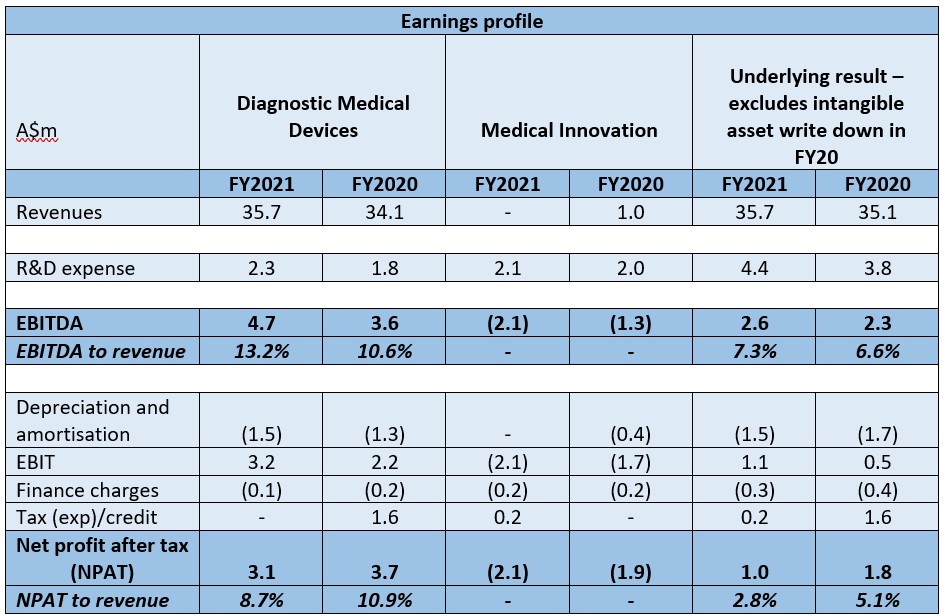

Core Diagnostic Medical Devices business separated from Medical Innovation business

The Company’s core Diagnostic Medical Devices business encompasses the technology and products currently sold globally for the diagnosis and/or monitoring of sleep disorders and neurological disorders, and for the monitoring of blood flow through the brain. It also includes products and technology used in advanced brain function research.

Compumedics’ Medical Innovation business primarily includes technologies and products for the consumer monitoring of sleep and subsequent treatment of sleep disorders.

Results for the Diagnostic Medical Devices business for the full year ended 30 June 2021:

- Shipped and invoiced sales were 5% higher at $35.7m for FY21, compared to $34.1m for FY20

- Sales orders taken in FY21, excluding MEG, were $35.3m, comparable with the previous corresponding period (pcp)

- NPAT for FY21 was $3.1m compared to $3.7m for FY20

- EBITDA was $4.7m for FY21 compared to $3.6m for FY20

- Cash on hand improved to $6.8m for FY21 compared to $6.4m for FY20

Results for the Medical Innovation business for the full- year ended 30 June 2021:

- Compumedics has consolidated its Nexus 360 installation base with over 56 customers across both PSG and EEG (> 350 beds and 110 systems) in both the USA and Australia. The Nexus 360 platform generated A$1.1m revenue in FY21, with total signed contract value exceeding A$1.7m in annual subscription fees. Revenues have continued to be temporarily impacted by the closure of labs due to the COVID-19 Pandemic.

- The Company has executed several research and collaborative arrangements during FY21 for the Somfit technology as part of its commercialisation path. The Company is engaged with third parties in relation to initial commercial applications for the Somfit technology.

- The Company continues to progress several other technology opportunities currently residing within the Medical Innovation Division and will make further announcements when appropriate.

CORPORATE

Key Growth Focus & Opportunities

The Company is focused on several initiatives to underpin both current and future growth, including:

- New product platform roll-out to continue in FY22

- The Company is poised to release a new range of ambulatory products for both its sleep and neurological diagnostic and monitoring businesses through late calendar 2021 and early calendar 2022. These have been further delayed, in part, due to the COVID-19 Pandemic

- This new range incorporates a Home Sleep Testing device as well as new ambulatory sleep devices and a new range of Long-Term Monitoring devices for epilepsy

- Neuroscan expansion into much larger MEG brain analysis imaging market

- Compumedics has undertaken the first phase of the installation of its first MEG sale at Barrow Neurological Institute in the US and continues to progress this installation, subject to working around COVID-19 Pandemic constraints and border closures

- The Company will continue to pursue further opportunities in this field during FY22 and is actively working known opportunities within the constraints of the COVID-19 Pandemic

- Growth in international sales with expansion plans in the USA, Germany, France and China markets

- The Company will continue to expand its USA sales team to grow market share in both sleep and neurological diagnostic and monitoring markets

- In Germany and France, the Company will pursue sales resources for both sleep and neurological diagnostic and monitoring markets there

- The Company will continue to build on its long-term relationships in China to grow the Company’s businesses in the region, subject to ongoing trade relationships

- eHealth: The Company is continuing to commercialise its cloud-based sleep diagnostics platform, Nexus 360, for both professional and consumer applications

- Compumedics has consolidated its Nexus 360 installation base with over 56 customers across both PSG and EEG (> 350 beds and 110 systems) in both the USA and Australia. The Nexus 360 platform generated A$1.1m revenue in FY21, with total signed contract value exceeding A$1.7m in annual subscription fees. Revenues have continued to be temporarily impacted by the closure of labs due to the COVID-19 Pandemic

- The Company has executed several research and collaborative arrangements during FY21 for the Somfit technology as part of its commercialisation path. The Company is engaged with third parties in relation to initial commercial applications for the Somfit technology

- DWL: Expansion opportunities with the newly granted break-through auto-scan TCD patent to be pursued

- The Company will continue to develop its technologies around the 3D Transcranial Colour Doppler (3D TCCD)/Duplex imaging, whilst refining the best way to fully exploit this commercial opportunity

FINANCIAL OUTLOOK & GROWTH PATHWAY

Compumedics expects the identified Key Growth Opportunities to deliver an increase in revenues and earnings in FY22, subject to the ongoing effects of the COVID-19 pandemic on the Company.

With that said, the ongoing and uncertain impacts of the COVID-19 Pandemic in relation to our key markets around the world continue to make it difficult to forecast the Company’s expected results, for any given future period, with a high level of certainty. As such, the Company remains unable to provide guidance currently whilst closely monitoring the timing of a resumption to more normal trading conditions when markets around the world fully reopen for business.

The Company will continue to actively manage this situation and keep the market fully informed to the extent it can and will reintroduce guidance as soon as conditions allow.

About Compumedics Limited

Compumedics Limited [ASX: CMP] is a medical device company involved in the development, manufacture and commercialisation of diagnostics technology for the sleep, brain and ultrasonic blood-flow monitoring applications. The Company owns US based Neuroscan and Germany based DWL Elektronishe GmbH. In conjunction with these two subsidiaries, Compumedics has a broad international reach, including the Americas, Australia and Asia Pacific, Europe and the Middle East.

Executive Chairman Dr. David Burton founded Compumedics in 1987. In the same year the Company successfully designed and installed the first Australian, fully computerised sleep clinic at Epworth Hospital in Melbourne. Following this early success, Compumedics focused on the development of products that sold into the growing international sleep clinic and home monitoring markets.

Compumedics listed on the Australian Securities Exchange in 2000. Over the years, Compumedics has received numerous awards, including Australia’s Exporter of the Year, and has been recognised as a Top 100 Innovator by both German and Australian governments.

For further information please contact:

Dr David Burton

Executive Chairman, CEO

Phone: + 61 3 8420 7300

Fax: +61 3 8420 7399

David Lawson

Director, CFO

Phone: + 61 3 8420 7300

Fax: +61 3 8420 7399

Rod North, Managing Director

Bourse Communications Pty Ltd

T: +61 3 9510 8309, M: 0408 670 706

E: rod@boursecommunications.com.au

Authorised for lodgment by Compumedics Limited’s Board of Directors